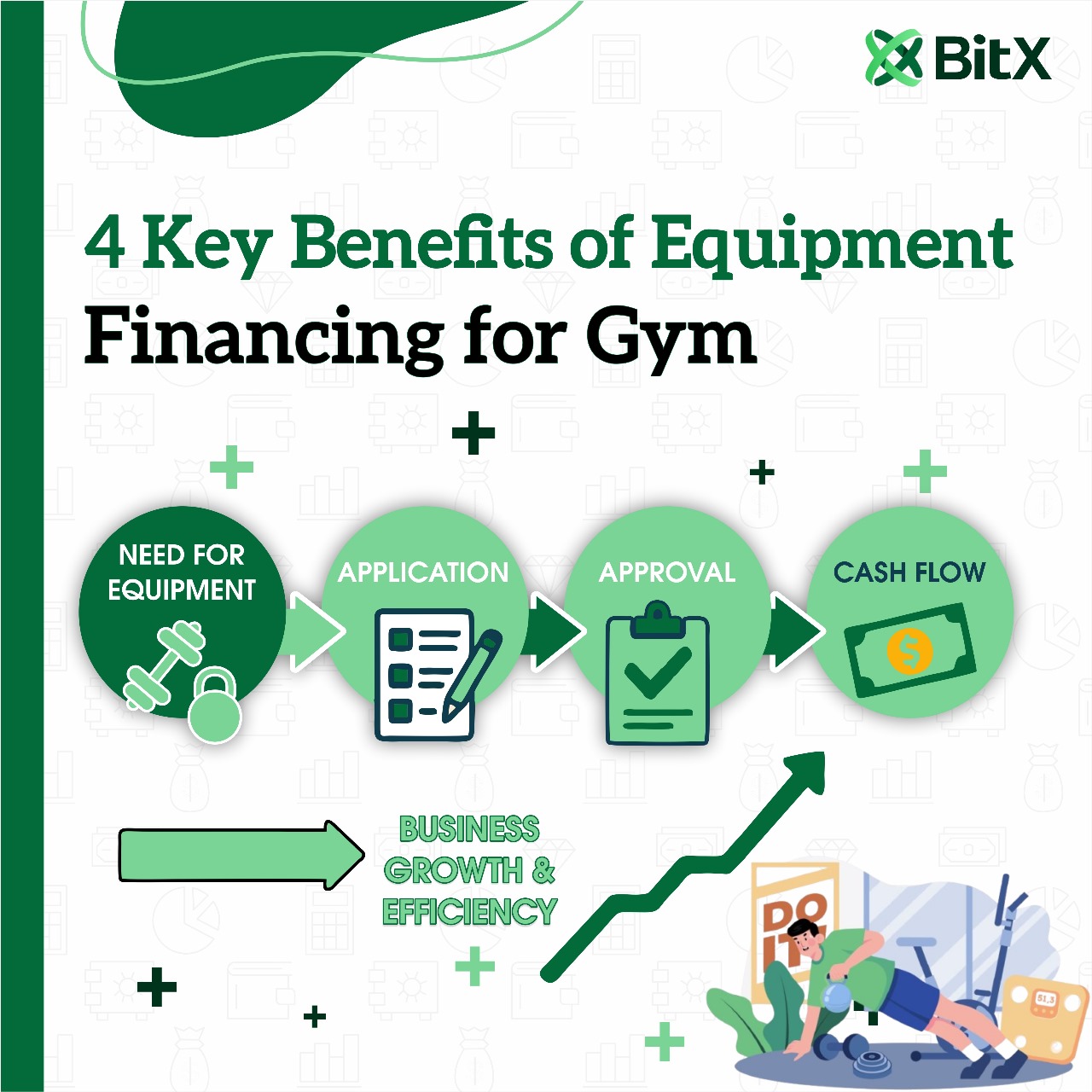

In the competitive landscape of the fitness industry, making sound financial decisions is crucial for gym owners looking to thrive and grow. One effective strategy gaining traction is equipment financing, which not only alleviates significant upfront costs but also unlocks access to the latest technology and equipment necessary to enhance the member experience.

By understanding the various benefits of equipment financing, gym owners can better position themselves for success, ensuring that they maintain healthy cash flow while investing in the tools that drive their business forward. This article explores four key advantages of equipment financing for gyms and how it can facilitate growth, flexibility, and innovation.

1. Preserve Critical Cash Flow

Running a gym is expensive, and the equipment can require significant upfront investments. By financing gym equipment, fitness business owners can preserve cash for other critical expenses like rent, marketing, and payroll.

Many different types of financing can help finance gym equipment, including revenue-based funding, working capital loans, merchant cash advance lenders, business term loans, and receivables factoring. However, choosing the right type of financing requires understanding the differences and comparing costs. Tools like a business loan calculator are essential to help you see the real cost of each option and make an informed decision.

Additionally, an equipment finance broker can be a valuable resource to help you find the best funding options for your specific needs. They specialize in matching businesses with lenders that fund the exact equipment they need.

2. Access to State-of-the-Art Equipment Immediately

In a world that has been transformed by new technology, it is crucial to stay up-to-date in order to offer your members the best possible experience. Whether it is equipment that provides a more efficient workout or software that helps them track their progress, gyms that use new technology are more likely to see success in their business.

For instance, smart scales have become a popular fitness tool that helps users monitor their health and fitness goals. Offering this device in your gym could give you an edge over competitors, since it will motivate people to keep working toward their fitness goals.

Virtual reality (VR) fitness is another new technology that is gaining traction. It allows users to immerse themselves in different workout environments, which can make the workout more fun and motivating.

3. Flexibility and Scalability for Growth

Whether you’re planning to open a new location, scale your business, or update equipment, the right finance solution can help you achieve your growth goals without sapping critical cash flow. With several lenders and different types of finance available, you’re sure to find a solution that suits your particular needs.

For example, if you want to grow your gym and need working capital to boost your cash flow, consider a flexible business loan. Alternatively, hire purchase (similar to leasing) is a long-term solution that can help you spread the cost of expensive equipment and ultimately own it once your contract ends. You can also opt for a line of credit that gives you revolving access to funds. This is perfect for equipment upgrades or seasonal cash flow fluctuations.

4. Hedge Against Obsolescence & Include Upgrades

When it comes to equipment, it is important for clubs to future-proof their investments. This is true both from a durability and functionality standpoint. You don’t want your cardio equipment breaking down frequently or offering a user experience that doesn’t meet your members’ needs.

Using an equipment loan or lease to acquire new equipment may help hedge against equipment obsolescence and/or incorporate upgrades. An operating lease, for example, typically requires little or no initial expense and preserves cash flow. An economic lease, meanwhile, can be the best option when you need to upgrade equipment frequently or achieve significant cost savings through new technology or efficiency.

The right equipment financing solution will depend on your unique business dynamics and financial situation, and a relationship-focused expert can guide you.

Conclusion

Bitx Capital offers tailored equipment financing solutions for gym owners, helping them invest in the latest technology and fitness equipment without the burden of significant upfront costs. With flexible terms and competitive rates, Bitx Capital enables gym owners to preserve cash flow, access state-of-the-art equipment, and support their growth, while ensuring a superior experience for their members.

Read More Gorod