A quarterly burn mechanism represents a structured approach to managing the supply of digital assets. Each event removes a fixed amount of tokens from circulation, which helps to maintain scarcity and encourage more consistent market activity. The clear design behind the process has created strong interest among investors who watch every update closely.

The process adds value by linking supply changes to measurable growth. Traders and long-term holders track results to see how supply shifts over time. For close followers, the quarterly burn highlights the evolving role of bnb coin in the market.

Quarterly Burn Process

The quarterly burn mechanism relies on predefined conditions tied to transaction levels and performance. Each cycle involves the permanent removal of tokens, ensuring that the total supply gradually decreases over time. This structure creates a system of predictable scarcity that investors can track and study.

Transparency remains central to the design, as each burn event is confirmed and recorded for public access. That openness builds trust among participants, who see a consistent framework in place. The repeatable process strengthens the credibility of the asset’s overall model.

Supply Reduction Effects

Reducing token supply has direct consequences on availability, which naturally influences how participants engage with the market. Scarcity can enhance the perceived value of the remaining tokens, which motivates many holders to stay invested. The regular nature of the reduction ensures that the impact is steady rather than sudden.

Investors usually anticipate outcomes connected with supply shifts. The planned nature of each event gives the market time to respond in a measured way. Because of that design, supply effects extend across both short-term adjustments and long-term positioning.

Investor Confidence Impact

Quarterly burns represent more than numerical changes to the supply. They serve as a signal of commitment to creating a sustainable environment for all participants. The consistent schedule of the mechanism underscores stability as a core principle.

The demonstration of active supply control builds assurance among those who seek a reliable asset structure. With clear signals about the system’s direction, investors can align their expectations more closely with the project’s path. This positive reinforcement encourages engagement and participation.

Strategic Market Role

The quarterly burn mechanism functions as a strategic tool that links growth to measurable activity. It provides a clear balance between expansion and control, reflecting deliberate economic planning. Through this balance, the system maintains alignment with long-term objectives.

The strategic role can be summarised with a few key points:

- It establishes a predictable framework for supply control

- It strengthens market discipline through scheduled activity

- It integrates scarcity with structured planning

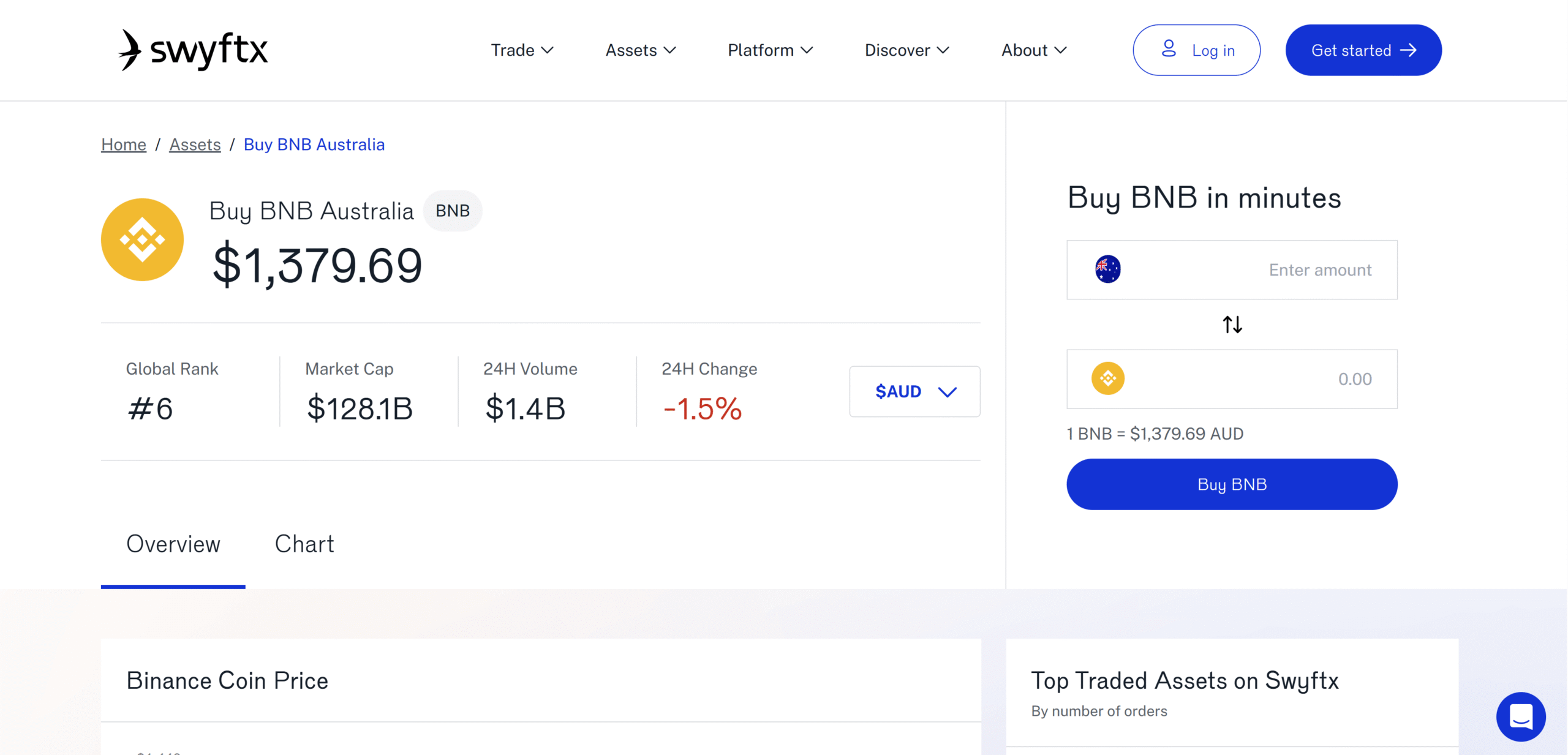

Choosing a Trusted Platform

Selecting a trusted platform is essential for anyone engaging with assets tied to quarterly burn mechanisms. A strong platform offers clear pricing, efficient trade execution, and easy navigation, which allows investors to focus on their strategy without unnecessary hurdles. The reliability of the platform directly shapes confidence and consistency in trading decisions.

The quarterly burn mechanism continues to shape the path of bnb coin by reducing supply and enhancing trust. Each scheduled event demonstrates a framework built on stability, scarcity, and transparent activity. Investors view the process as a guidepost for the asset’s progress, as it ties measurable actions to structured outcomes. Through its ongoing role, the burn mechanism remains a defining feature that signals the direction of growth and sustainability.

Read More Gorod