The automotive industry is increasingly reliant on advanced electronics to support features ranging from infotainment systems to advanced driver-assistance systems (ADAS) and electric vehicle (EV) battery management. Dynamic random-access memory (DRAM) plays a critical role in enabling these technologies, acting as the primary memory for processors that handle complex computational tasks. Consequently, a DRAM shortage automotive sector could have wide-ranging effects, from production delays to cost inflation, highlighting vulnerabilities in supply chain management and strategic planning.

As vehicles become more digitally sophisticated, the demand for DRAM in automotive manufacturing continues to rise. Each additional feature, whether it’s enhanced navigation, autonomous driving capabilities, or real-time connectivity, increases the amount of memory required per vehicle. A shortage of DRAM chips, therefore, is not merely a minor inconvenience; it has the potential to disrupt production schedules and slow innovation across the industry.

Supply Chain Vulnerabilities in Automotive Technology

A DRAM shortage automotive sector exposes critical vulnerabilities in the electronics supply chain. Automotive manufacturing relies on just-in-time production practices to maintain efficiency and reduce inventory costs. While these practices optimize capital allocation, they leave automakers particularly susceptible to component shortages.

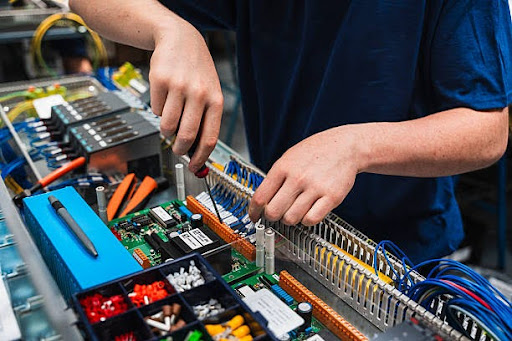

When DRAM availability is constrained, manufacturers may struggle to assemble vehicles on schedule. Chips that would normally power central processing units (CPUs) in vehicle control modules, infotainment systems, and ADAS devices become scarce. Suppliers might ration inventory, prioritize high-margin electronics products, or redirect shipments to industries with higher immediate demand, creating ripple effects throughout the automotive ecosystem.

Companies that lack alternative sourcing strategies or diversified supply networks are at the highest risk. A DRAM shortage in automotive contexts underscores the importance of building resilient, flexible supply chains capable of responding to global semiconductor fluctuations.

Production Delays and Financial Implications

The most immediate consequence of a DRAM shortage automotive manufacturing is delayed production. Vehicle assembly lines may face partial or complete shutdowns if essential memory components are unavailable. Delays can extend from weeks to months, depending on the severity of the shortage and the manufacturer’s ability to secure alternative DRAM sources.

Financially, production halts translate into lost revenue, unmet delivery commitments, and potential penalties. Automakers may also face higher component prices due to scarcity, adding cost pressures at a time when margins are already under strain. These financial impacts can be compounded by consumer expectations for new vehicles and the growing adoption of electronics-heavy EVs.

Impact on Vehicle Innovation and Technology

Modern vehicles are increasingly defined by their electronic features. A DRAM shortage automotive supply chain could hinder innovation by limiting access to memory chips necessary for developing and implementing new technologies. Features such as AI-powered driver-assistance systems, real-time traffic data processing, and high-resolution touchscreens rely heavily on DRAM.

Manufacturers may be forced to prioritize which models or features receive the available memory chips, delaying or scaling back innovations in lower-priority segments. This can slow the adoption of next-generation automotive technologies, impacting competitive positioning and potentially affecting long-term brand perception.

Strategic Responses to DRAM Shortages

Addressing a DRAM shortage automotive environment requires proactive planning and strategic sourcing. Companies can invest in long-term supplier relationships, secure contracts that guarantee minimum supply levels, or diversify their component procurement across multiple DRAM manufacturers.

Additionally, collaboration with chip suppliers to forecast demand accurately and communicate production schedules is critical. Automotive manufacturers increasingly turn to integrated supply chain planning tools to monitor inventory, track shipments, and identify bottlenecks before they escalate into major disruptions.

Industry Insights and Market Trends

According to industry insight, the DRAM market is highly cyclical, influenced by global events, production capacity, and demand from sectors such as PCs, mobile devices, and servers. The automotive sector competes with these markets for the same memory components, often facing delays when high-volume consumer electronics orders take priority.

Understanding how a DRAM shortage automotive production impacts supply chain stability can inform better investment decisions and risk mitigation strategies. Industry analysts emphasize the importance of monitoring global memory trends, maintaining flexible inventory policies, and leveraging partnerships with distributors that specialize in automotive-grade DRAM.

Long-Term Implications for Automotive Manufacturing

A persistent DRAM shortage automotive scenario could accelerate structural changes in the industry. Manufacturers may invest in memory-efficient software, explore alternative memory technologies, or adjust vehicle designs to reduce dependency on high-end DRAM components.

Additionally, automakers may reconsider their sourcing strategies by increasing vertical integration or establishing strategic reserves of critical semiconductor components. By reducing reliance on volatile supply channels, manufacturers can buffer against future shortages and maintain production stability even during market disruptions.

Conclusion

The impact of a DRAM shortage automotive supply chain is multifaceted, affecting production schedules, financial performance, innovation capabilities, and strategic planning. As vehicles continue to integrate more advanced electronics and computational features, the importance of DRAM as a critical component will only grow.

Automakers that proactively address supply chain risks, secure diverse sourcing channels, and invest in memory-efficient designs are better positioned to weather shortages and maintain competitive advantage. Insights from the industry highlight the need for flexible, resilient procurement strategies and long-term planning to mitigate the effects of memory shortages.

Ultimately, a DRAM shortage in automotive manufacturing is not just a temporary logistical challenge—it is a wake-up call for the industry to rethink supply chain resilience, technological planning, and strategic partnerships in an era where semiconductors are the backbone of innovation.