Financial reporting is the backbone of transparency and trust in modern organizations. It informs stakeholders about financial health, supports regulatory compliance, and guides strategic decision-making. Yet, as data volumes grow and regulations evolve, traditional reporting methods—often manual, fragmented, and time-consuming—are struggling to keep pace. This is where generative AI for financial reporting is emerging as a powerful enabler of efficiency, accuracy, and intelligence.

The Growing Need for Intelligent Financial Reporting

Organizations today manage data across multiple systems, geographies, and regulatory frameworks. Manual consolidation and reporting processes not only slow down closing cycles but also increase the risk of human error and compliance gaps. Finance teams are under pressure to deliver faster, more insightful reports while maintaining strict accuracy and governance standards.

Generative AI addresses these challenges by automating complex reporting workflows and extracting meaningful insights from vast datasets. By learning patterns from historical financial data, AI models can generate narratives, summaries, and analyses that go beyond static numbers—helping finance leaders focus on strategy rather than spreadsheets.

Understanding Generative AI in the Finance Context

Generative AI refers to a class of artificial intelligence models capable of creating new content—such as text, summaries, or insights—based on patterns learned from data. In financial reporting, this means transforming raw financial data into structured reports, explanations, and forward-looking insights.

Unlike traditional automation tools that follow predefined rules, generative AI adapts to context. It can analyze financial statements, identify trends, flag anomalies, and even draft management discussion and analysis (MD&A) sections, all while maintaining consistency and compliance.

Key Use Cases of Generative AI for Financial Reporting

Automating Financial Statement Generation

One of the most impactful applications is the automation of financial statement preparation. Generative AI can compile data from multiple sources, reconcile figures, and generate standardized reports such as balance sheets, income statements, and cash flow statements—significantly reducing manual effort and closing time.

Enhancing Regulatory Compliance and Governance

Compliance with standards like SOX, IFRS, or local regulatory frameworks is non-negotiable. Generative AI helps ensure consistency and accuracy by embedding compliance checks into reporting workflows. It can also maintain detailed audit trails, making reviews and audits more efficient.

Risk Detection and Anomaly Identification

By continuously analyzing financial data, AI models can detect unusual patterns, inconsistencies, or potential fraud indicators early. This proactive risk management capability strengthens internal controls and supports more reliable reporting.

Insightful Narrative and Management Reporting

Generative AI excels at converting numbers into narratives. It can generate clear explanations of financial performance, variances, and trends tailored to different stakeholders—executives, boards, or investors—improving clarity and decision-making.

Key applications of generative AI in financial reporting

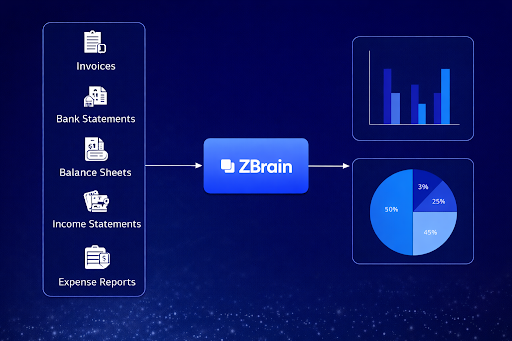

Generative AI is transforming financial reporting by automating data-intensive workflows, improving analytical depth, and strengthening compliance across the reporting lifecycle. By reducing manual intervention and enabling intelligent insights, organizations can produce faster, more accurate, and decision-ready financial reports. Below are the key applications where generative AI delivers the greatest impact, along with how ZBrain supports each use case.

Automated financial document creation

Generative AI enables the automated creation of core financial statements such as balance sheets, income statements, and cash flow reports directly from raw financial data.

ZBrain processes large datasets, extracts relevant financial information, and generates structured, regulator-ready documents in multiple formats. Its intelligent document generation capabilities, including tools like ZBrainDocs, ensure consistency, accuracy, and compliance across financial disclosures.

Financial audit preparation

Preparing for financial audits often requires extensive data collection, coordination, and documentation. Generative AI streamlines this process by automating report generation and communication workflows.

ZBrain enhances audit readiness by automating financial documentation, issuing timely reminders, and maintaining up-to-date financial records through its audit preparation agents—reducing delays and audit risk.

Information extraction and summarization

Financial teams frequently need to extract key insights from contracts, invoices, and regulatory filings. Generative AI simplifies this by rapidly identifying and summarizing critical information.

ZBrain scans financial documents, extracts relevant data points, and delivers concise summaries, improving speed and accuracy in financial analysis and decision-making.

Data-driven financial analysis

Generative AI analyzes historical and real-time financial data to uncover trends, performance indicators, and potential risks.

ZBrain combines internal financial records with external market data to produce data-backed analyses that offer a comprehensive view of financial performance, future patterns, and emerging risks.

Cash flow and liquidity management

Maintaining liquidity is essential for financial stability. Generative AI enables real-time monitoring of cash inflows and outflows to support proactive financial planning.

ZBrain delivers real-time liquidity insights through dedicated cash flow and liquidity optimization agents, helping organizations anticipate shortages, optimize reserves, and ensure accurate liquidity reporting.

Streamlined accounts reconciliation

Manual reconciliation of accounts receivable and cash applications is time-consuming and error-prone. Generative AI automates these processes to improve accuracy and timeliness.

ZBrain’s cash application automation agent matches cash receipts to customer accounts, reduces reconciliation errors, and ensures real-time updates to financial statements.

Accounts receivable and transaction reconciliation

Tracking client payments and reconciling transactions across ledgers and bank statements is critical for accurate reporting.

ZBrain automates payment tracking and transaction matching through intelligent agents that reconcile general ledger entries with bank statements, improving audit readiness and operational efficiency.

AI-powered regulatory and tax compliance

Ensuring compliance with accounting standards, data privacy regulations, and tax laws is a major challenge in financial reporting.

ZBrain continuously scans financial documents for compliance gaps, flags discrepancies, and supports regulatory adherence through specialized agents, including GDPR monitoring and corporate tax review automation.

Risk detection and fraud prevention

Generative AI plays a vital role in identifying financial risks, anomalies, and potential fraud by continuously monitoring financial activity.

ZBrain’s financial risk mitigation agents assess market, credit, and operational risks, delivering actionable insights that help finance teams proactively manage threats and maintain financial stability.

Budget variance analysis and strategic insights

Comparing budgeted versus actual financial performance is essential for accurate reporting and informed decision-making.

ZBrain’s variance analysis agent automatically identifies deviations, generates detailed variance reports, and helps organizations refine financial strategies with data-driven insights.

Integration Approaches for AI-Driven Financial Reporting

Organizations can adopt generative AI through different integration strategies depending on their needs and resources.

Custom AI Solutions

Custom-built AI systems offer maximum flexibility and control. They are tailored to specific reporting requirements, data structures, and compliance needs. While powerful, they require higher investment and technical expertise.

AI Point Solutions

These are pre-built tools designed to address specific tasks such as data extraction, reconciliation, or report summarization. They are quicker to deploy and cost-effective but may lack scalability for complex enterprise-wide reporting needs.

Fully Integrated AI Platforms

End-to-end platforms provide a unified environment for data ingestion, model selection, workflow orchestration, and deployment. Solutions like ZBrain enable organizations to operationalize Generative AI for financial reporting at scale by combining automation, analytics, and governance in a single platform.

Why ZBrain Stands Out for AI-Driven Financial Reporting

ZBrain is a full-stack generative AI orchestration platform designed to handle complex, data-intensive processes like financial reporting. Its low-code environment allows finance teams to build and customize AI workflows without extensive programming expertise.

Key strengths include robust data integration across financial systems, model-agnostic support for multiple large language models, and built-in evaluation tools to ensure output accuracy. ZBrain also emphasizes security, scalability, and compliance—critical factors for handling sensitive financial data.

Challenges and Considerations in Adoption

While the benefits are compelling, adopting generative AI requires careful planning.

Data Quality and Integrity

AI models are only as reliable as the data they use. Ensuring accurate, complete, and well-governed financial data is essential.

Security and Privacy

Financial data is highly sensitive. Strong encryption, access controls, and private deployment options are necessary to safeguard information.

Explainability and Human Oversight

Generative AI should complement—not replace—human expertise. Transparent models and human-in-the-loop validation help mitigate bias and ensure ethical reporting.

Skills and Change Management

Successful implementation also depends on upskilling finance teams and driving user adoption through training and clear communication.

The Future Outlook of Generative AI in Financial Reporting

The future of financial reporting will be increasingly automated, real-time, and insight-driven. Generative AI is expected to enable continuous reporting, predictive financial insights, and highly personalized reports for different stakeholders. Advances in explainable AI will further enhance trust and regulatory acceptance, while AI-powered assistants will support finance teams with on-demand analysis and guidance.

Endnote

Generative AI is redefining how organizations approach financial reporting—shifting it from a manual, retrospective exercise to a strategic, intelligence-driven function. By automating routine tasks, enhancing accuracy, and delivering deeper insights, generative AI empowers finance leaders to focus on value creation and informed decision-making.

Platforms like ZBrain demonstrate how enterprises can responsibly harness this technology at scale, balancing automation with governance and human oversight. As adoption grows, organizations that invest early in AI-driven financial reporting will be better positioned to navigate complexity, ensure compliance, and maintain a competitive edge in an increasingly data-driven financial landscape.